Many talk about the psychology of trading and how important it is to develop a mindset that is conducive to being consistently successful at this endeavor. However, there seems to very little written about how to actually live through the daily riggers of trading. How to live through the daily, weekly or monthly drawdowns that plague us … well daily, weekly, monthly.

Living through drawdowns is the key to successful trading, bar none. If you can’t live through a drawdown you will not be a successful trader. It’s that simple. Hopefully this article will help you to do just that.

Since this is such an important subject I will be addressing a different aspect of living through these times in the next few newsletters so I can expound upon each point.

What is a drawdown?

Notice the title of this article is not live through “a” drawdown but live through drawdowns – plural. And I’m not talking about the MAX drawdown, I’m talking about the drawdowns you will be in most of your trading career.

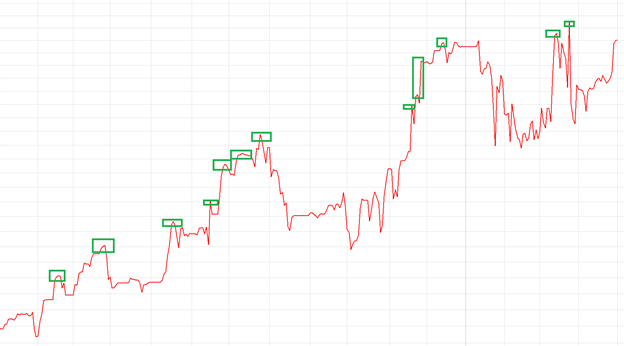

A drawdown is the dip between new equity highs in your equity curve, it’s as simple as that. So, by definition, you can see a trader will spend most of his/her time in drawdowns. Some traders think drawdowns are a rare event, or at most, a once a year or quarter event – but the fact of the matter is that traders will spend more than 75% of their time in a drawdown.

Here’s an equity curve of a very successful algorithm. The Green boxes are new equity highs. This is when your account is making more than it’s ever made trading this system. These are your feel good times. Now look at the Red line when it’s not in one of the green boxes, for this is “the rest of the story.” The red line is you living in a drawdown. I’m thinking 75% of your time in a drawdown may be a little too conservative and that it may be more.

So if you’re going to spend more than ¾ of your time in this quagmire called a drawdown, you need to learn how to live through it/them.

I have a list of 5 things that won’t make them easier but will help to navigate drawdowns a little more elegantly.

This is not meant to be funny. Your ability to handle drawdowns, hands down, is dependent completely upon how mentally prepared you are for them. This means it’s crucial you know your system’s past Max Drawdown as well as you know your own birthday. However, just like that birthday, you should expect to visit a drawdown of equivalent size once a year then, an even bigger one sometime in the future.

If you’re trading, and consider yourself a trader, you need to be very aware of what will happen to your account during that drawdown. If you do, you will be mentally prepared and have the intestinal fortitude to stick with the program through these challenging times.

If you’re not prepared psychologically for the drawdown, you will make emotionally driven decisions at the worst possible time in the worst possible place. These emotional decisions lead to that trait all bad traders share – selling at the lows or its doppelganger, buying at the highs. How many of you have done that?

One of the most important benefits of trading with an algorithm is to eliminate those counterproductive emotional decisions. Please don’t offset that leverage by acting emotionally when in DD.

Next week we will talk about #2 Measure your Drawdown – watch this space!

Why should I use an OPG order and what the heck is it anyways?

Has this ever happened to you?

You place your market order to sell XYZ at the opening price. However, your trade doesn’t execute until 9:32 a.m. ET, and by then, the price is lower than it was at the market open. What happened?

If you mark your order as a DAY order, many brokers will hold these orders until the markets open before routing them to the exchange. Even in this age of split-second transfers, it can still take a few minutes for an exchange to receive and queue your order. Therefore, your order gets filled a few minutes after the open.

The opening price for a stock is calculated by taking all the pre-market orders and setting a price that satisfies the greatest number of buyers and sellers. That price then becomes the opening price. This is the reason why we often see gaps between yesterday’s closing price and today’s opening price.

So how do we tell our broker that we want to participate in the opening price by submitting our order prior to the open?

We use a different TIF (time in force) designation for our order.

Instead of using a DAY order we use an OPG order (when trading with Interactive Brokers). If you use a different broker, be sure to check with them as to how they indicate market on open orders. Some brokers use MOO instead of OPG.

Here’s an example of an order to sell 100 shares of MSFT at the open with Interactive Brokers. Notice that instead of using DAY, we use OPG.

An OPG order will be accepted if it is received by the exchange before 9:15AM (ET). The order can be cancelled after 9:15AM, but it cannot be edited. After 9:28AM, OPG orders cannot be edited or cancelled. If you are placing your trades the evening before, you should have no problems here.

Now keep in mind that if you use a LIMIT order with an OPG, if the order isn’t filled on the open, it will be cancelled. So for those portfolios that use LIMIT orders to exit positions, do not use the OPG designation. Use DAY instead.

There are no guarantees in life or trading. But by using the OPG designation for your market exits, you will find that your fills will more accurately reflect a stock’s opening price. And your number of bad fills will greatly decrease.