U.S. markets showed strength for the 4th-straight session following positive trade negotiations with China after the country offered a 6-year boost in imports. According to reports, China would increase its annual import of U.S. goods by a combined value of over $1 trillion.

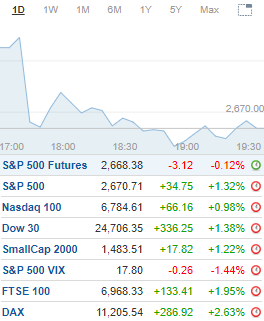

China pegged its proposal to buy more U.S. goods through 2024 in a deal that would aim to reduce that annual trade deficit reduce to $0 by 2024. The news helped capped the 4th-straight weeks of gains with the overall market getting off to its best start since 1987.The Dow zoomed 1.4% on the late day push to 24,750. New and lower resistance at 24,750-25,000 was tapped but held with a close above the latter and the 200-day moving signaling additional strength.The S&P 500 surged 1.3% after reaching a midday peak of 2,675. Fresh and lower resistance at 2,675-2,700 was tagged but held with a close above the latter getting 2,725-2,750 and the 200-day moving average in the mix.For the week, the Dow gained 3% while the S&P 500 jumped 2.9%.The Russell 2000 rallied 1% after testing an intraday high 1,487. Upper resistance at 1,465-1,480 was cleared and held to get 1,500 in play on continued closes above the latter.The Nasdaq also rose 1% following the second half push to 7,185. Fresh and lower resistance is now at 7,200-7,250 on continued closes above the 7,150 level.The Nasdaq was up 2.7% for the week and the Russell 2000 rose 2.5%.Industrials were the strongest sector after advancing 1.9% while Financials and Materials were higher by 1.7%. There were no sector laggards for the 2nd-straight session.For the week, Financials soared 4.6% and Industrials popped 3.4% higher. There was no sector weakness.The market is closed on Monday in observance of the Martin Luther King Jr. holiday.

Arista Networks (ANET) upgraded to Buy from Neutral at Nomura InstinetChevron (CVX) upgraded to Buy from Neutral at UBSEdwards Lifesciences (EW) upgraded to Buy from Neutral at BofA/MerrillCasa Systems (CASA) downgraded to Equal Weight from OverweightNautilus (NLS) downgraded to Neutral from Buy at SidotiSignet Jewelers (SIG) downgraded to Sell from Neutral at Citi

EARNINGS Tuesday Before the Open (EST):Allegheny Technologies (ATI), Fifth Third Bancorp (FITB), Halliburton (HAL), HomeStreet (HMST), Johnson & Johnson (JNJ), Old National Bancorp (ONB), PetMed Express (PETS), Prologis (PLD), Stanley Black & Decker (SWK), Steel Dynamics (STLD), Travelers Companies (TRV), Union Bancshares (UBSH)Tuesday After the Close (EST): Accuray (ARAY), Capital One Financial (COF), FB Financial (FBK), Hope Bancorp (HOPE), Interactive Brokers (IBKR), International Business Machines (IBM), K12 (LRN), Navient (NAVI), TD Ameritrade (AMTD), United Financial Bancorp (UBNK), Zions Bancorporation (ZION)

UPCOMING ECONOMIC NEWS Tuesday’s Economic Reports (EST):Redbook – 8:55amExisting Home Sales – 10:00am

METALS / OIL

Gold closed at $1,282.60 an ounce, down $9.70Silver settled at $15.40 an ounce, down $0.14

Copper finished at $2.72 a pound, up $0.04

Crude Oil is at $53.56 a barrel, up $1.31

Bitcoin Investment Trust (GBTC) ended at $4.34, down $0.09

I hope this helps you prepare for the trading day. Make it a great one!

Todd Mitchell

Enter your text here…

Copyright © 1994-2018 Trading Concepts, Inc.

All Rights Reserved.