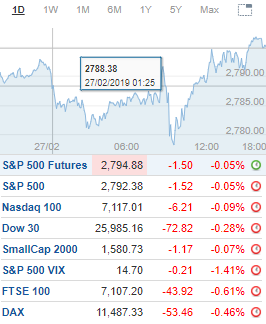

U.S. markets showed weakness for a 3rd-straight session with the major averages settling mixed as Wall Street digested the latest economic and political news. While both fronts played a role in market direction, the lower lows remain a slight concern although major support levels held for the 2nd-straight session.

In a reversal of this week’s technical pattern, the small-caps showed strength while the overall market lagged. Volatility also stayed elevated after trading to a higher high but the lower close is helping to confirm this week’s consolidation pattern.The Russell 2000 climbed 0.2% after testing a second half high of 1,582. Prior and lower resistance at 1,585-1,600 and the 200-day moving average held with a close above the latter signaling a return of momentum.The Nasdaq edged up 0.1% following the intraday push to 7,562. Lower resistance at 7,550-7,600 was cleared and held with continued closes above the latter being a bullish signal for continued strength.The S&P 500 dipped 0.1% after testing a morning low of 2,775. Current and upper support at 2,775-2,750 held on the 2nd-straight lower low with a close below the latter and the 200-day moving average being a bearish development.The Dow was down 0.3% following morning pullback to 25,877. Fresh and upper support at 26,000-25,750 failed to hold for the 1st time in 4 sessions held with a close below the latter signaling lower lows.Energy, Industrials and Financials were all up 0.4% while Utilities nudged up 0.1%.Communications Services and Healthcare showed the most sector weakness after falling 0.5%. Real Estate declined 0.3%.

INSTANTLY identify markets with the Highest Relative Strengththat will allow you to Minimize Risk & Maximize yourProfit Potential!

Boise Cascade (BCC) upgraded to Buy from Neutral at DA DavidsonPhilip Morris (PM) upgraded to Buy from Neutral at UBSW. R. Berkley (WRB) upgraded to Outperform from Neutral at Credit Suisse

Chubb (CB) downgraded to Underperform from Neutral at Credit SuisseHome Depot (HD) downgraded to Hold from Buy at DZ BankUnilever (UN, UL) downgraded to Neutral from Outperform at Exane BNP Paribas

EARNINGS Thursday Before the Open (EST):AMC Networks (AMCX), Anheuser-Bush (BUD), Cars.com (CARS), Endava (DAVA), Frontline (FRO), Herc Holdings (HRI), JC Penney (JCP), Keurig Dr Pepper (KDP), LKQ (LKQ), Marriott Vacations World (VAC), Nomad Foods (NOMD), Party City (PRTY), Sotheby’s Holdings (BID), TD Bank (TD), Urogen (URGN), Verso (VRS)Thursday After the close(EST):3D Systems (DDD), AMC Entertainment (AMC), Culp (CULP), Funko (FNKO), Gap (GPS), Live Nation (LYV), Nordstrom (JWN), Pure Storage (PSTG), Splunk (SPLK), Upwork (UPWK), Workday (WDAY), Zix (ZIXI)

UPCOMING ECONOMIC NEWS Thursday’s Economic Reports (EST):Jobless Claims – 8:30amGDP – 8:30amChicago PMI – 9:45am

METALS / OIL

Gold closed at $1,321.20 an ounce, down $7.30Silver settled at $15.77 ounce, down $0.06

Copper finished at $2.96 a pound, up $0.01

Crude Oil is at $56.99 a barrel, up $1.00

Bitcoin Investment Trust (GBTC) ended at $4.30, down $0.06

I hope this helps you prepare for the trading day. Make it a great one!

Todd Mitchell

Step #2: Enroll in an Advisory or Educational ProgramPremium Advisories | Featured Educational Programs

Step #3: Connect with The CommunityTrading Concepts Official Facebook Page