It’s about the size of New Mexico and you can’t see a single inch of it from the sky. It’s under the Pacific Ocean and if you set sail about 1,000 miles east of Japan – you might run into it.

Welcome to the world’s largest volcano and one of the biggest in the solar system.

Its name: Tamu Massif, and it’s causing scientists to rethink their long-held beliefs about marine geology. When this one blows you literally won’t see it coming until it’s too late. (Of course we say this because it’s under water – but we’ll know well in advance.)

Every quarter, there are hundreds of massive underwater volcanoes getting ready to blow in the market. They take the form of earnings season and they can send share prices soaring – or plummeting.

If you know what to look for, you could have a tidy little payday waiting for you every three months. Yet most investors and traders steer clear. This doesn’t have to be the case if you know how to trade these events.

Before you start looking up the exotic origins of Tamu Massif’s name, let us be the first to pull the covers back. Tamu actually stands for Texas A&M University. And Massif? That’s French for ‘massive’, and is a scientific term for a large mountain.

So the origin of the name is ordinary, and it’s been sitting right in front of you all along.

The same is true with a publicly traded company’s earning announcement. They’re scheduled well in advance. They’re sitting right in front of you every quarter. And their impact on the market is impossible to miss.

Why? Because they provide a clear, unmistakable glimpse into a company’s performance – and the market’s belief on share price value.

Take three recent earnings announcements, starting with two market ‘massifs’ in the form of AMZN (Amazon) and CI (Cigna).

Two market ‘massifs’ and two eruptions – right on schedule!

In both instances, the market reaction was instantaneous – big jumps. In the case of Amazon, a huuuuuge jump of over $150. An absolute long call trade’s dream.

So what? Big deal, everyone knows that earnings announcements have the potential to impact share price. What should you be looking for, and how can you trade them?

Interestingly enough, the massive Tamu Massif volcano went inactive shortly after it was formed – 145 million years ago. By ‘inactive’, scientists mean that it went extinct. It was a combination of elements – including tectonic plates, thin crust and of course HOT MAGMA that led to the volcanic formation.

When evaluating an earnings announcement, you don’t need tectonic plates or 145 million years. You just need HOT MAGMA – in the form of either good news or bad news. From there, you need to look to historical movement during earnings season.

Specifically, what has the average price swing/fluctuation been when earnings news comes out? Add to that the implied volatility that’s shown in the options chain leading up to the weekly and monthly options for that ticker.

Remember that the market has likely already priced the volatility into the share price – there’s nothing new that you’re going to see going into the announcement. This actually makes your life easier. Instead of combing through annual reports and analysis summaries from the company’s analysts – you can simply sit back and look for a volcano.

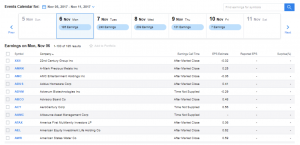

Here’s a perfect place to start, and it will cost you nothing: Head to Yahoo’s earnings calendar. You’ll see every publicly traded stock that’s on deck for an announcement.

A perfect place to begin your volcano hunting project!

Once you know where to look, now you just have some basic screening to complete and you’ll have your watch list.

Just so we’re clear, an eruption date hasn’t been set for Tamu Massif. But the dates have been set well in advance for earnings announcements. Looking at this particular week, there are over 750 potential ‘volcanoes’ set to erupt.

To narrow down the list, simply look for three basic characteristics:

Once you have your watch list in place – wait for price to erupt. From there, you’ll be watching for the fade as the market calms down – and then the range. Once the prevailing range sets in – you’ll have your chance to make your move!

Don’t let anyone tell you there aren’t scheduled stock events that can build your account.

Happy volcano hunting during earnings season!