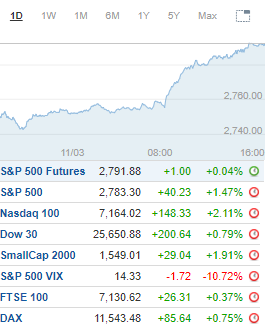

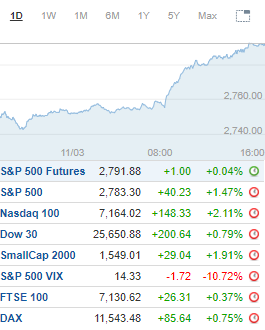

U.S. markets snapped a 5-session slide despite early weakness in the blue-chips following an upbeat interview with Fed Chair Jerome Powell that aired Sunday evening. Powell said despite global headwinds, the Fed is not in any hurry to alter rates for now and remains patient.

The rebound cleared prior and near-term resistance levels with volatility falling back below a key level of support. March

expiration week is typically bullish but there are a number of headwinds that remain in play before Friday’s closing bell to see if a near-term bottom has been formed.The Nasdaq showed the most strength after surging 2% while tapping an intraday high of 7,558. Prior resistance at 7,500-7,550 and the 200-day moving average was cleared and held to set up a possible run towards 7,600-7,650.The Russell 2000 rallied 1.9% after testing an intraday high of 1,548 and session peak. Prior and lower resistance at 1,540-1,550 was cleared and held with continued closes above the latter signaling a possible near-term bottom.The S&P 500 soared 1.5% following the late day run to 2,784. Fresh and lower resistance at 2,775-2,800 was tripped and held on the close back above the 200-day moving average with a move above the latter being a continuing bullish signal.The Dow climbed 0.8% despite the opening weakness to reach a late day peak of 25,661. Current and lower resistance at 25,600-25,800 was cleared and held on the 453-point rebound with continued closes above 26,000 being a more bullish signal.Technology led sector strength after zooming 2.2%. Communication Services and Energy rose 1.7% and 1.6%.

There were no sector laggards.

These unique ‘Income Trades’ have limited riskand they typically play out in a few days.

Perfect for boosting your weekly income and buildingyour retirement account.

Go here tolearn more about Creating a Steady Stream of Profits Each WeekLike Clockwork…

Apple (AAPL) upgraded to Buy from Neutral at BofA/MerrillFacebook (FB) upgraded to Buy from Neutral at Nomura InstinetSpirit Airlines (SAVE) upgraded to Overweight from Equal Weight at BarclaysJetBlue (JBLU) downgraded to Equal Weight from Overweight at BarclaysNucor (NUE) downgraded to Neutral from Buy at LongbowOracle (ORCL) downgraded to Reduce from Buy at Nomura Instinet

EARNINGS Tuesday Before the Open (EST):BG Staffing (BGSF), Commercial Vehicle Group (CVGI), Dick’s Sporting Goods (DKS), International Seaways (INSW), KLX energy Services (XLXE), Momo (MOMO), Northern Oil & Gas (NOG), Orion Marine Group (ORN), Synlogic (SYBX), Townsquare Media (TSQ), Wireless Telecom Group (WTT)Tuesday After the close(EST):American Public Education (APEI), Bridgepoint Education (BPI), Clean Energy Fuels (CLNE), Earthstone Energy (ESTE), Goldfield (GV), International Money Express (IMXI), Limoneira (LMNR), Natera (NTRA), Purple Innovation (PRPL), Sunworks (SUNW), Switch (SWCH), Team (TISI), Zagg (ZAGG), ZTO Express (ZTO)

UPCOMING ECONOMIC NEWS Tuesday’s Economic Reports (EST):NFIB Small Business Optimism Index – 6:00amCPI – 8:30amRedbook – 8:55am

METALS / OIL

Gold closed at $1,291.10 an ounce, down $8.20

Silver settled at $15.27 an ounce, down $0.08

Copper finished at $2.90 a pound, up $0.01

Crude Oil was at $56.83 a barrel, up $0.53

Bitcoin Investment Trust (GBTC) ended at $4.62, down $0.24

I hope this helps you prepare for the trading day. Make it a great one!

Todd Mitchell

Step #2: Enroll in an Advisory or Educational ProgramPremium Advisories | Featured Educational Programs

Step #3: Connect with The CommunityTrading Concepts Official Facebook Page