U.S. markets showed continued strength on Tuesday following word a bipartisan deal has been reached to avert another government shutdown. However, President Trump wasn’t too thrilled and is undecided on the budget deal after meeting with cabinet members.

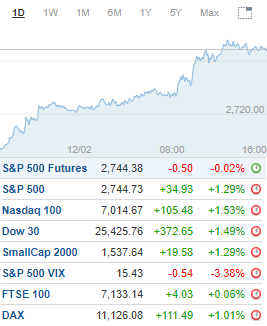

News on trade also helped the major indexes push fresh highs for the year, aside from the blue-chips, after Trump said he wants to meet China’s President Xi very soon. Meanwhile, volatility tapped a new low for 2019 while closing below key levels of support.The Dow darted 1.5% higher after reaching an intraday peak of 25,458 while snapping a 4-session slide. Prior and lower resistance at 25,250-25,000 was nearly breached but held with a move above the latter being a continuing bullish signal.The Nasdaq also jumped 1.5% after trading to a late day high of 7,419. Upper resistance at 7,350-7,400 was cleared and held to setup a run towards 7,450 and the 200-day moving average.The S&P 500 soared 1.3% following the 2nd half run to 2,748. Major resistance at 2,750 and the 200-day moving average held into the closing bell with continued closes above the latter setting up a run towards 2,775-2,780.The Russell 2000 also rose 1.3% following push to 1,538 shortly after the closing bell. Fresh resistance is at 1,540-1,550 on continued closes above 1,525-1,515 with a move below the latter signaling caution.Materials showed the most sector strength after after rallying 2.2%. Industrials gained 1.6% while Consumer Discretionary and Financials were higher by 1.5%.Real Estate was the only sector laggard after falling 0.7%.

Evergy (EVRG) upgraded to Buy from Neutral at BofA/MerrillJohn Bean Tech (JBT) upgraded to Gradually Accumulate from Hold at Wellington ShieldsRio Tinto (RIO) upgraded to Buy from Neutral at Goldman SachsCisco (CSCO) downgraded to Equal Weight from Overweight at Morgan StanleyGilead (GILD) downgraded to Neutral from Buy at CitiTake-Two (TTWO) downgraded to Underperform from Market Perform at BMO Capital

EARNINGS Wednesday Before the Open (EST):Acco Brands (ACCO), Black Knight (BKI), CBRE Group (CBRE), Dish Network (DISH), Flir Systems (FLIR), Global Payments (GPN), Hilton Worldwide (HLT), Kelly Services (KELYA), LouisianaPacific (LPX), Perion Network (PERI), Teva Pharmaceutical (TEVA), Wyndham Hotels & Resorts (BH)

Wednesday After the Close (EST): American International (AIG), Cisco Systems (CSCO), Diodes (DIOD), Equinix (EQIX), Fossil (FOSL), HCP (HCP), Hyatt Hotels (H), JMP Group (JMP), MGM Resorts (MGM), NetApp (NTAP), Perspecta (PRSP), Quidel (QDEL), Sleep Number (SNBR), TripAdvisor (TRIP), Waste Connections (WCN), Yelp (YELP)

UPCOMING ECONOMIC NEWS Wednesday’s Economic Reports (EST):MBA Mortgage Applications – 7:00amCPI – 8:30am

METALS / OIL

Gold closed at $1,314.00 an ounce, up $2.10Silver settled at $15.69 an ounce, unchanged

Copper finished at $2.77 a pound, down $0.02

Crude Oil is at $53.39 a barrel, up $1.00

Bitcoin Investment Trust (GBTC) ended at $4.39, up $0.16

I hope this helps you prepare for the trading day. Make it a great one!

Todd Mitchell

Copyright © 1994-2018 Trading Concepts, Inc.

All Rights Reserved.