U.S. markets were weak throughout Thursday’s action following comments from NEC Director Larry Kudlow who warned that there is a pretty sizable distance to go on China trade negotiations. There was also chatter that Presidents Trump and Xi are highly unlikely to meet before the March trade/tariff deadline, which added to the nervousness.

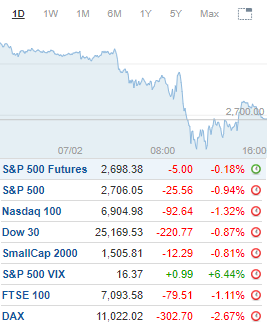

The major indexes were able to hold near-term support levels, for the most part, while volatility spiked x% but held a key level of resistance.The Nasdaq gave back 1.2% after testing an opening low of 7,235. Fresh support at 7,250-7,200 was split on the close above the former with a move below the latter signaling lower lows.The S&P 500 sank 0.9% after trading to a midday low of 2,687. Lower support at 2,725-2,700 was breached but held with a close below this level being a slightly bearish signal.The Dow also dropped 0.9% following the intraday backtest to 25,000. Lower support at 25,250-25,000 and the 200-day moving average held on the close below the former.The Russell 2000 declined 0.8% following the morning dip to 1,494. Major and lower support at 1,510-1,500 was breached but held with risk towards 1,485-1,475 on a close below this level.Utilities and Real Estate were the only sectors to show strength after advancing 1.3% and 0.9%, respectively.Energy led sector weakness after plummeting 2.2%. Materials and Technology stumbled 1.4%.

Cognizant (CTSH) upgraded to Outperform from Market Perform at BMO CapitalGuess (GES) upgraded to Buy from Hold at JefferiesSpirit Airlines (SAVE) upgraded to Buy from Neutral at Goldman SachsDunkin’ Brands (DNKN) downgraded to Neutral from Buy at KalinowskiEssex Property Trust (ESS) downgraded to Hold from Buy at JefferiesOmega Healthcare (OHI) downgraded to Hold from Buy at Stifel

EARNINGS Friday Before the Open (EST):Arconic (ARNC), Buckeye Partners (BPL), Cae (CAE), Coty (COTY), Exelon (EXC), Goodyear Tire & Rubber (GT), Hasbro (HAS), Phillips 66 (PSX), Radian Group (RDN), Univar (UNVR), Ventas (VTR)

Friday After the Close (EST): Cameco (CCJ)

UPCOMING ECONOMIC NEWS Thursday’s Economic Reports (EST):Wholesale Inventories – 8:30amBaker-Hughes Rig Count – 1:00pm

METALS / OIL

Gold closed at $1,314.20 an ounce, down $0.20Silver settled at $15.71 an ounce, up $0.01

Copper finished at $2.82 a pound, down $0.01

Crude Oil is at $52.65 a barrel, down $1.32

Bitcoin Investment Trust (GBTC) ended at $3.87, up $0.03

I hope this helps you prepare for the trading day. Make it a great one!

Todd Mitchell

Copyright © 1994-2018 Trading Concepts, Inc.