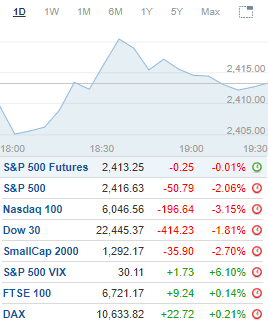

U.S. markets closed sharply lower Friday, as Wall Street braced for a partial government shutdown and slowing global growth. The losses punctuated five days of selling pressure with fresh 52-week and multi-year lows now in focus.The Dow joined the other major indexes after officially forming a death-cross and has followed the Transports lower as the two tend to trade in tandem.

Surprisingly, volatility stayed relatively calm despite the continued market pullback but did close at its highest level since early February.

The Russell 2000 plummeted 2.6% following the intraday drop to 1,289 and close below the 1,300 level. Longer-term support is at 1,275-1,250 on continued weakness and represents prior resistance from August 2016.The Nasdaq tanked 1.6% after testing a low of 6,304. September 2017 support at 6,300-6,250 held with a move below the latter getting 6,200-6,150 in play.For the week, the Nasdaq dropped 8.4% while the Russell 2000 sank 7.6%.The Dow stumbled 1.8% after testing an intraday low of 22,396. Lower support at 22,600-22,400 held into the close with backup help at 22,250-22,000 on a close below the latter.The S&P 500 was rocked for 2.1% after bottoming at 2,408 intraday. Major and upper support from July 2017 at 2,400-2,375 held with risk to 2,350-2,300 on a move below the latter.The S&P 500 fell 7.1% for the week while the Dow slid 6.9%.There was no sector strength for the 5th-straight session with heavy losses for the week.Communication Services and Technology were the weakest sectors after giving back 3.3% and 3%, respectively. Energy plunged 10% for the week while Consumer Staples and Consumer Discretionary were hammered with losses of 7.7% and 7.5%.

CyberArk (CYBR) upgraded to Buy from Hold at Deutsche Bank Nike (NKE) upgraded to Buy from Hold at Pivotal ResearchShopify (SHOP) upgraded to Buy from Neutral at DA DavidsonAltria Group (MO) downgraded to Sell from Neutral at CitiFacebook (FB) downgraded to Sell from Hold at DZ BankTeradyne (TER) downgraded to Neutral from Outperform at Baird

Monday’s earnings announcements (EST):

No major announcements. Market open half day, closed on Tuesday for Christmas.

UPCOMING ECONOMIC NEWS Monday’s Economic Reports (EST):Chicago Fed National Activity Index – 8:30am

METALS / OIL

Gold closed at $1,258.10 an ounce, down $9.80Silver settled at $14.70 an ounce, down $0.17

Copper finished at $2.67 a pound, down $0.03

Crude Oil is at $45.42 a barrel, down $0.65

Bitcoin Investment Trust (GBTC) ended at $4.32, down $0.31

I hope this helps you prepare for the trading day. Make it a great one!

Todd Mitchell

Copyright © 1994-2018 Trading Concepts, Inc.

All Rights Reserved.