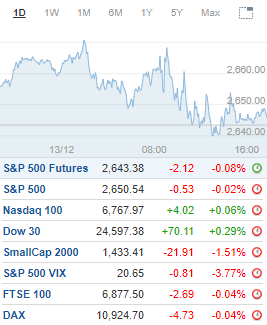

U.S. markets struggled on Thursday after trading in a tighter trading range with the major indexes finishing mixed. Despite some positive developments, ongoing trade tensions between the U.S. and China remain the biggest factor influencing momentum.

The small-caps led the overall market pullback while the blue-chips showed strength. Volatility continues to settle down after testing another weekly low but remains above key support levels.The Russell 2000 was down for the 6th time in 7 sessions after sinking 1.6% while testing a low of 1,431. Prior and upper supper at 1,440-1,420 was breached and failed to hold with the recent 52-week low at 1,422.The Nasdaq had its 3-session winning streak snapped after falling 0.4% on the backtest to 7,034. Upper support at 7,000-6,950 held with a close below the latter likely leading to additional selling pressure.The S&P 500 slipped a half-point, or 0.02% following the second half fade to 2,637. Upper support at 2,625-2,600 held with a close below the latter being a bearish development.The Dow was up 0.3% after trading within a 267-point range and tapping a morning high of 24,740. Near-term and lower resistance at 24,800-25,000 held for the 2nd-straight session.Utilities led sector strength after rising 0.9%. Real Estate and Consumer Staples were higher by 0.7% and 0.6%, respectively.Materials paced sector laggards after dropping 1.2%, respectively. Financials fell 0.7% while Consumer Discretionary and Communications Services gave back 0.5%.

Tractor Supply (TSCO) upgraded to Buy from Hold at Deutsche BankProcter & Gamble (PG) upgraded to Buy from Neutral at BofA/MerrillDycom (DY) upgraded to Buy from Hold at Craig-Hallum

FireEye (FEYE) downgraded to Equal Weight from Overweight at Morgan Stanley Sabre (SABR) downgraded to Hold from Buy at Deutsche Bank Weatherford (WFT) downgraded to Underperform from Market Perform at Raymond James

Friday’s earnings announcements (EST):

Before the open: Lee Enterprises (LEE)

After the close: None

UPCOMING ECONOMIC NEWS Friday’s Economic Reports (EST):Retail Sales – 8:30amIndustrial Production – 9:15amPMI Composite Flash – 10:00amBusiness Inventories –10:00amBaker-Hughes Rig Count – 1:00pm

METALS / OIL

Gold closed at $1,244.40 an ounce, down $2.60Silver settled at $14.85 an ounce, unchanged

Copper finished at $2.77 a pound, unchanged

Crude Oil is at $53.02 a barrel, up $1.83

Bitcoin Investment Trust (GBTC) ended at $3.88down $0.17

I hope this helps you prepare for the trading day. Make it a great one!

Todd Mitchell

Copyright © 1994-2018 Trading Concepts, Inc.

All Rights Reserved.