U.S. markets showed momentum throughout much of Wednesday’s action as the major indexes held their gains after President Trump said trade talks with China by phone were moving along very well. While this remains a major headwind, the market responded well as it could be anticipating a deal sooner rather than later.

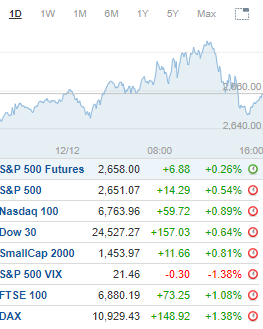

Although there was a slight fade into the closing bell, a near-term bottom could be in progress as the small-caps led the move higher. Volatility remains a wild card but is trending lower with major support back in play.The Russell 2000 rallied 1.1% after trading to an intraday peak of 1,471.Near-term resistance at 1,465-1,480 was split but held with a close above the latter being a slightly bullish signal.The Nasdaq advanced 1% following the midday run to 7,197. Fresh resistance at 7,150-7,200 held with continued closes above the latter signaling a possible near-term bottom.The Dow gained 0.6% after trading reaching an afternoon peak of 24,828. Near-term and lower resistance at 24,800-25,000 was cleared but failed to hold with a close above the latter and the 200-day moving average being a bullish development.The S&P 500 was up 0.5% following the second half push to 2,685. Lower resistance at 2,675-2,700 was cleared but failed to hold with continued closes above the latter signaling additional momentum.Consumer Discretionary and Communication Services were higher by 1.1% to lead sector strength. Materials and Healthcare rose 0.9%.Real Estate and Utilities led sector laggards after falling 1.9% and 0.6%, respectively. Consumer Staples slipped 0.1%.

Corcept Therapeutics (CORT) upgraded to Overweight from Neutral at Cantor FitzgeraldLululemon (LULU) upgraded to Buy from Neutral at CitiRealty Income (O) upgraded to Neutral from Sell at Citi

eBay (EBAY) downgraded to Equal Weight from Overweight at Morgan StanleyMorgan Stanley (MS) downgraded to Market Perform from Outperform at Keefe BruyetteVerizon (VZ) downgraded to Equal Weight from Overweight at Morgan Stanley

Thursday’s earnings announcements (EST):

Before the open: Ciena (CIEN), DLH Holdings (DLHC), Fred’s (FRED), Veru (VERU)

After the close: Adobe Systems (ADBE), Cherokee (CHKE), Costco Wholesale (COST), David’s Tea (DTEA), Good Times Restaurant (GTIM), Pure Bioscience (PURE)

UPCOMING ECONOMIC NEWS Thursday’s Economic Reports (EST):Jobless Claims – 8:30amImport and Export Prices – 8:30am

METALS / OIL

Gold closed at $1,250.00 an ounce, up $2.80Silver settled at $14.85 an ounce, up $0.22

Copper finished at $2.77 a pound, unchanged

Crude Oil is at $51.19 a barrel, down $0.81

Bitcoin Investment Trust (GBTC) ended at $4.05up $0.10

I hope this helps you prepare for the trading day. Make it a great one!

Todd Mitchell

Copyright © 1994-2018 Trading Concepts, Inc.

All Rights Reserved.