U.S. markets showed continued weakness on Monday as a rise in the U.S. dollar and lingering worries about global trade weighed on sentiment. Oil price concerns also played a role after Saudi Arabia said it would cut its oil production, while the Organization of the Petroleum Exporting Countries said it is also considering a more sweeping reduction of output.

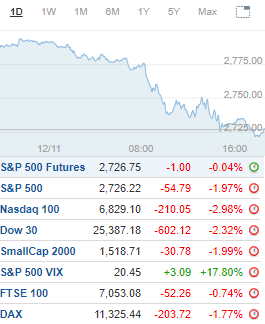

The major indexes hit their lows late in the day on reports the White House was circulating a draft report on auto tariffs. Volatility spiked nearly 18% while closing back above a key level of resistance.The Nasdaq plunged 2.8% after trading to an intraday low of 7,193. Fresh and late October support at 7,200-7,150 held with the index giving back its gains for the month.The S&P 500 sank 2% with the low reaching 2,722 on the close back below the 200-day moving average. Upper support at 2,725-2,700 held by a point with risk to 2,650-2,600 on a close below the latter.The Dow tanked 2.3% following the pullback to 25,340 while closing back below its 50-day moving average. Fresh and upper support at 25,400-25,200 failed to hold into the close with a move below the latter being a continued bearish signal.The Russell 2000 fell 2% after tapping a session low of 1,518. Lower support at 1,525-1,520 was breached and keeps further risk towards 1,500-1,490 in play.Real Estate gained 0.2% and was the only sector that showed strength.Technology easily paced sector weakness after plummeting 3.5%. Energy was off 2.2% while Financials, Consumer Discretionary and Industrials were down 2.1%, respectively.

Armstrong World (AWI) upgraded to Neutral from Underperform at BofA/MerrillCrocs (CROX) upgraded to Neutral from Negative at SusquehannaStarbucks (SBUX) upgraded to Buy from Hold at Argus

AB InBev (BUD) downgraded to Hold from Buy at ArgusCheesecake Factory (CAKE) downgraded to Underweight from Equal Weight at BarclaysSkyworks Solutions (SWKS) downgraded to Neutral from Buy at Citi

Tuesday’s earnings announcements (EST):

Before the open: Advance Auto Parts (AAP), Beazer Homes (BZH), Cae (CAE), Eyenovia (EYEN), Home Depot (HD), National Vision Holdings (EYE), Optinose (OPTN), Tyson Foods (TSN)

After the close: Boxlight (BOXL), Cardlytics (CDLX), Five Point Holdings (FPH), iCad (ICAD), PetIQ (PETQ), Resideo Technologies (REZI), Switch (SWCH), Tilray (TLRY), Wix.com (WIX)

UPCOMING ECONOMIC NEWS Tuesday’s Economic Reports (EST):NFIB Small Business Optimism Index – 6:00amRedbook – 8:55amTreasury Budget – 2:00pm

METALS / OIL

Gold closed at $1,203.50 an ounce, down $5.10Silver settled at $14.01 an ounce, down $0.13

Copper finished at $2.68 a pound, unchanged

Crude Oil is at $58.86 a barrel, down $1.01

Bitcoin Investment Trust (GBTC) ended at $6.91 down $0.15

I hope this helps you prepare for the trading day. Make it a great one!

Todd Mitchell

Copyright © 1994-2018 Trading Concepts, Inc.

All Rights Reserved.