U.S. markets showed continued weakness on Thursday as hopes of a trade dispute resolution with China took an unexpected back step. The prospects of a heightened tariff war was back in focus following the arrest of a major CFO from a Chinese Tech company.

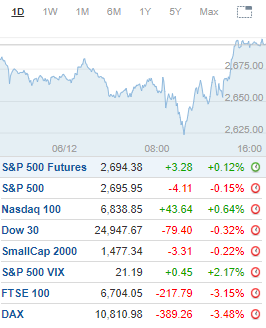

While the White House knew of the arrest over the weekend, it caught the market by surprise with heavy selling on the open. The second half rebound off the lows was slightly encouraging despite the VIX pushing prior October peaks.The Dow was down 0.3% following the pullback to 24,242. Major and lower support at 24,300-24,250 held with risk to 24,000 and late June lows on continued selling pressure.The Nasdaq was up 0.4% despite trading to an intraday low of 6,984. Late November support at 7,000-6,950 held with the index erasing a 174-point decline to close just below the 7,200 level.The S&P 500 was off 0.2% after testing a session low of 2,621 while closing just below the 2,700 level. Prior support at 2,625 held with risk to 2,600 and fresh October lows on a close below the latter.The Russell 2000 also slipped 0.2% following the backtest to 1,442. Prior and upper February support at 1,450-1,440 was breached but levels that held into the close.Real Estate led sector strength after rallying 2.7%. Communication Services was up 0.5%.Energy was the the worst performing sector after giving back 1.8%. Materials and Financials were lower by 1.4

Activision Blizzard (ATVI) upgraded to Overweight from Neutral at JPMorganBristol-Myers (BMY) upgraded to Outperform from Market Perform at BMO CapitalSynopsys (SNPS) upgraded to Buy from Hold at Benchmark

Bluebird Bio (BLUE) downgraded to Neutral from Overweight at Piper JaffrayFacebook (FB) downgraded to Hold from Buy at StifelToll Brothers (TOL) downgraded to Sector Perform from Outperform at RBC Capital

Friday’s earnings announcements (EST):

Before the open: Big Lots (BIG), Integrated Electrical Services (IESC), Johnson Outdoors (JOUT), Vail Resorts (MTN)After the close: OilDri (ODC)

UPCOMING ECONOMIC NEWS Friday’s Economic Reports (EST):Employment Report – 8:30amConsumer Sentiment – 10:00amWholesale Trade – 10:00amBaker-Hughes Rig Count – 1:00pm

METALS / OIL

Gold closed at $1,238.10 an ounce, down $3.00Silver settled at $14.51 an ounce, down $0.13

Copper finished at $2.74 a pound, down $0.02

Crude Oil is at $52.68 a barrel, down $0.57

Bitcoin Investment Trust (GBTC) ended at $4.51down $0.24

I hope this helps you prepare for the trading day. Make it a great one!

Todd Mitchell

Copyright © 1994-2018 Trading Concepts, Inc.

All Rights Reserved.