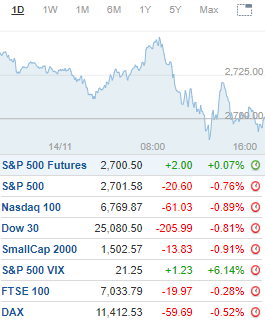

U.S. markets showed strength on Wednesday’s open before turning south afterwards and showing weakness for the 5-straight session. The rebound off the lows was slightly encouraging but October lows remain in play.A death-cross has officially formed in the small-caps for the first time in 2 1/2 years and remains a concern.

Meanwhile, volatility spiked to its highest level of the month but held key levels of resistance.The Nasdaq was down 0.9% after testing an intraday low of 7,101. Late October support at 7,100-7,050 held with a close 7,000 likely leading to additional selling pressure.The S&P 500 was lower by 0.8% following the pullback to 2,685. Upper support at 2,700-2,675 held with risk to 2,625-2,600 and October lows on a close below the latter.The Dow declined 0.8% after trading to an intraday low of 24,935. Fresh and upper support at 25,000-24,800 held but the close below the 200-day moving average was a slightly bearish development.The Russell 2000 also fell 0.8% after tapping a session low of 1,494. Upper support at 1,500-1,490 was breached with a close below the latter likely getting 1,480-1,460 in play.Communication Services gained 0.5% and was the only sector that closed in positive territory.Financials tanked 1.4% and Technology was down 1.2% to lead sector weakness. Utilities fell 1% while Healthcare and Consumer Discretionary stumbled 0.8%.

Aramark (ARMK) upgraded to Outperform from Neutral at BairdCAE (CAE) upgraded to Outperform from Neutral at MacquarieTD Ameritrade (AMTD) upgraded to Overweight from Equal Weight at Morgan Stanley

Apple (AAPL) downgraded to Neutral from Buy at GuggenheimKellogg (K) downgraded to Neutral from Overweight at JPMorganTenneco (TEN) downgraded to Underweight from Equal Weight at Morgan Stanley

Thursday’s earnings announcements (EST):

Before the open: Brady (BRC), Eros International (EROS), Ideal Power (IPWR), JC Penney (JCP), Manchester United (MANU), Pointer Telocation (PNTR), Walmart (WMT)

After the close: Applied Materials (AMAT), Digi International (DGII), Globant (GLOB), Matthews International (MATW). Nordstrom (JWN), Nvidia (NVDA), Post Holdings (POST), Shoe Carnival (SCVL), Williams-Sonoma (WSM)

UPCOMING ECONOMIC NEWS Thursday’s Economic Reports (EST):Jobless Claims – 8:30amPhiladelphia Fed Business Outlook Survey – 8:30amRetail Sales – 8:30amEmpire State Manufacturing Survey – 8:30amImport and Export Prices – 8:30amBusiness Inventories –10:00am

METALS / OIL

Gold closed at $1,210.10 an ounce, up $8.70Silver settled at $14.08 an ounce, up $0.10

Copper finished at $2.71 a pound, up $0.02

Crude Oil is at $56.11 a barrel, up $0.42

Bitcoin Investment Trust (GBTC) ended at $5.98 down $0.89

I hope this helps you prepare for the trading day. Make it a great one!

Todd Mitchell

Copyright © 1994-2018 Trading Concepts, Inc.

All Rights Reserved.