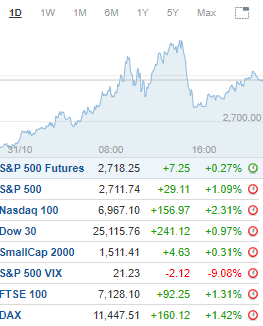

U.S. markets wrapped up a volatile month with the S&P 500 and Nasdaq closing higher in back-to-back sessions for the first time since September. The recent rebound is signaling a possible near-term bottom is in but the rest of the week has a number of high profile earnings due out.The longer-term technical outlook remains slightly bearish but the major indexes could follow the Dow’s lead in making a run towards their 200-day moving averages on continued strength.

Volatility is showing signs of easing but remains just above an uncomfortable level for the bulls.

The Nasdaq surged 2% while testing a session high of 7,368. Fresh resistance at 7,350-7,400 held with a close above the latter being a continued bullish signal.The S&P 500 jumped 1.1% after trading to a second half high of 2,736. Fresh and lower resistance at 2,735-2,750 held with continued closes above the latter being a more bullish development.For October, the Nasdaq was the worst-performing major index, dropping 9.2% and its biggest monthly loss since November 2008. The S&P 500 shed 6.9% for its biggest monthly decline since September 2011.The Dow was higher by 1% following the intraday push to 25,336. Near-term resistance at 25,350-25,400 and the 200-day moving average were held by the bears with a close above the latter signaling additional strength.The Russell 2000 added 0.3% after reaching a morning peak of 1,526. Near-term resistance at 1,525-1,535 held with a close above 1,540 being a more bullish signal.The Russell 2000 tanked 11% while the Dow sank 5.1% in October for its biggest monthly percentage fall since January 2016.Technology and Communication Services were the strongest sectors after rallying 2.4% and 2.1%. Financials and Materials advanced 1.4%.Real Estate and Utilities were down 1.4% and 1.2%, respectively, and were the weakest sectors. Consumer Staples was off 1% to round out the losers.For October, Utilities and Consumer Staples were the only positive sectors after rising 3.2% and 3%. Energy plummeted 11.9% while Industrials were hammered for an 11.5% loss. Consumer Discretionary plunged 11.3%, Materials were hit for 10.4%, and Technology tanked 10.1% to round out the double-digit percentage losers.

Comerica (CMA) upgraded to Strong Buy from Outperform at Raymond JamesDenny’s (DENN) upgraded to Overweight from Equal Weight at StephensEli Lilly (LLY) upgraded to Neutral from Underperform at Credit SuisseClovis (CLVS) downgraded to Neutral from Overweight at JPMorganQualcomm (QCOM) downgraded to Neutral from Buy at BofA/MerrillWeatherford (WFT) downgraded to Neutral from Buy at Guggenheim

Thursday’s earnings announcements (EST):

Before the open: Aircastle (AYR), Ball (BLL), Cigna (CI), Dominion Energy (D), Exelon (EXC), Gartner (IT), GasLog (GLOG), Generac Holdimgs (GNRC), HanesBrands (HBI), Insperity (NSP), InterDigital (IDCC), iStar (STAR), LendingTree (TREE), Madison Square Garden (MSG), MGM Growth Properties (MGP), NetScout Systems (NTCT), New York Times (NYT), Oshkosh (OSK), Penn National Gaming (PENN), Pitney Bowes (PBI), Quanta Services (PWR), Radius Health (RDUS), Sealed Air (SEE), Sotheby’s Holdings (BID), Teleflex (TFX), TreeHouse Foods (THS), Veeco Instruments (VECO), Wayfair (W), Zoetis (ZTS)

After the close: Alleghany (Y), Apple (AAPL), Bovie Medical (BVX), Cardtronics (CATM), CBS (CBS), El Pollo Loco Holdings (LOCO), EOG Resources (EOG), Fluor (FLR), GoPro (GPRO), Host Hotels & Resorts (HST), Kaman (KAMN), Kraft Heinz (KHC), Live Nation Entertainment (LYV), Metlife (MET), Motorola Solutions (MSI), Pixelworks (PXLW), Rogers (ROG), Shake Shack (SHAK), Starbucks (SBUX), Trimble Navigation (TRMB), United States Steel (X), Viavi Systems (VIAV), Weight Watchers International (WTW), Western Union (WU)

UPCOMING ECONOMIC NEWS Thursday’s Economic Reports (EST):Challenger Job-Cut Report – 7:30amJobless Claims – 8:30amProductivity and Costs – 8:30amPMI Manufacturing Index – 9:45amISM Manufacturing Index – 10:00amConstruction Spending – 10:00am

METALS / OIL

Gold closed at $1,215.00 an ounce, down $10.30Silver settled at $14.28 an ounce, down $0.18

Copper finished at $2.66 a pound, unchanged

Crude Oil is at $64.91 a barrel, down $1.27

Bitcoin Investment Trust (GBTC) ended at $6.74 up $0.08

I hope this helps you prepare for the trading day. Make it a great one!

Todd Mitchell

Copyright © 1994-2018 Trading Concepts, Inc.

All Rights Reserved.